Cash discount programs can be a saving grace for business owners looking to cut costs on credit card processing fees.

If you’re a business owner, you most likely process multiple credit card transactions on a daily basis.

Selling a product to a customer paying with a credit card sounds like a good way to make a profit, but did you know that you lose an unnecessary amount of money every time a customer chooses to pay with a card rather than cash?

Consumers understand the conveniences and benefits of paying with a credit card. Perks, such as cash back, persuade buyers to use credit cards over cash. They reap the benefits, but you’re the one to pay the price.

It’s all part of credit card processing fees.

Using a credit card is considered a privilege, and like most privileges, it comes at a cost. Small fees are charged to the merchant for every processed credit card transaction.

These small fees add up fast and can result in a huge loss of profit for your business. You’re losing hundreds, if not thousands, of dollars of your hard earned money every month to processing fees.

But don’t worry! Some processing companies, like Dual Payments, understand the burden of losing a vast amount of money to credit card processing fees.

As a result of their efforts, business owners just like you can completely eliminate their credit card processing fees by adopting a cash discount program, otherwise known as zero fee processing.

This article will teach you all the ins and outs of credit card processing, and everything you need to know about cash discounting!

Table of Contents

ToggleWhat’s Credit Card Processing All About?

Before learning about the benefits of a cash discount program, you must understand the complicated process of paying credit card processing fees.

As explained above, credit card processing occurs everytime a customer pays for a good or service by using a credit card.

While the customer may be the one experiencing the convenience of using a credit card, the merchant is typically the one to pay the price.

While there are many moving parts to credit card processing, you must first understand the fees you are paying.

You may look at your statement at the end of the month and wonder where all your money is going.

If you’re paying thousands of dollars every month to process credit cards, you should at least understand what kind of fees you’re paying and why you’re paying them, right?

You’ve already learned that fees can pile up quickly and subtract from a merchant’s profit.

For example, if you own a bookstore, a customer may desire to purchase a $15 novel using their credit card. For a typical business still paying fees for credit card processing, the compiled fees of processing that credit card transaction could amount to as high as 4.0% of the purchase price. You as a merchant just lost $0.60 off your profit.

If you sell 100 books every day, you would lose $60 dollars on a daily basis, and $1,860 in a 31-day month. That’s money out the door you’d probably rather be saving.

So what are the fees that are causing you to lose all this money every month? The following are two examples of different credit card processing fees that are depleting your profit:

- Interchange Fee: Also known as a swipe fee, the interchange fee is the largest portion of your credit card processing fees. It consists of a percent + some fixed amount. With a traditional credit card processing system, you’ll be charged this fee everytime a customer uses a credit card.

- Assessment Fee: This is the processing fee that goes directly to the credit card company, such as Visa and Master Card.

Interchange fees and assessment fees are coupled with other fees, such as incidental fees, to create a mountain of credit card processing fees.

Thousands of businesses lose money every day to credit card processing fees while sticking to the traditional processing systems.

Where’s All This Money Going?

That bookstore’s $60 a day has to go somewhere, right? And you probably know from your financial statements that it’s not ending up in your wallet.

So, if a percentage of the profit doesn’t go to the merchant who actually makes the sale, where does it go?

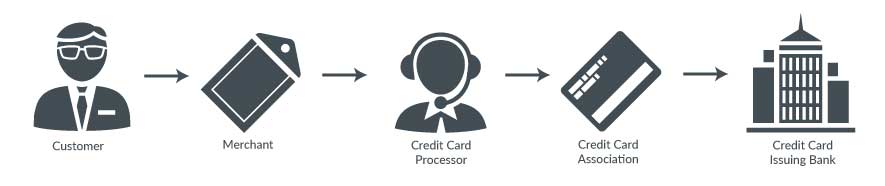

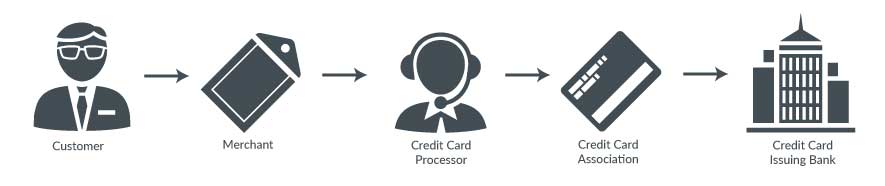

Well, there are a lot of middlemen that exist between the customer and the merchant, and they all want a piece of the profit pie.

The following are five middlemen waiting for you to willingly put money in their pockets:

- Credit Card Associations: These are the companies that make the credit cards, such as Visa and Master Card. The assessment fees are paid directly to them.

- Credit Card Processors: These are sometimes called Acquiring Banks or Acquirers. They are the link between merchants and credit card associations. Anytime a credit card is processed, information and authorization requests are carried by credit card processors to and from merchants and credit card associations.

- Merchant Account Provider: This player manages the credit card processing, and they’re not going to do it for free!

- Credit Card Issuing Banks: The banks that issue the credit card will jump on the opportunity to make some more money, and part of the credit card processing fees go to them.

As you can see, there are a lot of players involved in the authorization of credit card transactions, and with a traditional credit card processing system, you’re going to be the one who has to pay them.

How Do I Pay The Middle Men?

The best answer is that you don’t.

Seriously, you can completely eliminate all credit card processing fees with a cash discount.

But, if you like the black hole in your bank account, there are a few typical pricing models to choose from:

- Tiered Model: Also known as bundling, the tiered model sorts your transactions into three categories: qualified, mid-qualified, and non-qualified. The qualified category has the lowest rates, and the non-qualified has the highest rates. Sound confusing? That’s because it is. This model allows for excessive fees if criteria are not met.

- Interchange Plus: The interchange plus model itemizes fees and lists the wholesale fees and markups separately on your monthly statement. The transparency of this model may sound appealing, but it still contains the processing fees that could otherwise be eliminated.

- Subscription/Membership Plan: Like the interchange plus model, this plan charges interchange fees and markups separately. However, with this plan you don’t pay a percentage on the markup, rather you pay a fee for the transaction. What’s the drawback? You’re still paying fees!

- Blended: All costs are blended together with a consistent percentage and a transaction fee. This typically raises transaction fees and costs you more money as a merchant.

All four of the pricing models listed above are great ways to lose money!

However, you don’t have to lose any money at all if you convert to a cash discount program.

Cash Discount Processing

Finally, it’s time to learn how you can stop paying all credit card processing fees!

While all of the above pricing models cost you and your business money, implementing a cash discount program results in eliminating your credit card processing fees quickly and easily.

Typically, a merchant pays an interchange fee everytime a customer pays with a credit card.

However, a cash discount program transfers the fee to the paying customer.

But is this fee just a surcharge?

Many business owners worry that transferring the fee to the customer in a cash discount program may be that same as implementing a surcharge.

A surcharge is a fee that is added toward the price of an item when a customer uses a credit card.

Surcharges can only be assessed on credit cards, not debit cards, and are only legal in 40 of the 50 states.

However, a cash discount differs from a surcharge by offering customers an incentive to pay with an alternative method of payment, such as with cash or a check.

A small service fee is applied to all customer transactions. If a customer pays with cash, the fee is lifted.

Terminals collect the service fees paid by customers paying with credit cards and use them to pay the merchant’s credit card processing fees.

Sounds good, but is it legal?

Unlike surcharges, cash discount processing is legal in all 50 states.

However, the merchant must implement steps to ensure its legality.

The merchant must provide notifications regarding the cash discount and service fee at all entrances and points of sale. Examples of this may include a sign near the door, at the payment terminal, or somewhere else in the store. The goal is to make your customer aware.

While not mandatory, merchants may also decide to provide a verbal notification at the point of sale. This can be accomplished by saying something along the lines of, “would you like to save 4.0% on your purchase by paying with cash?”

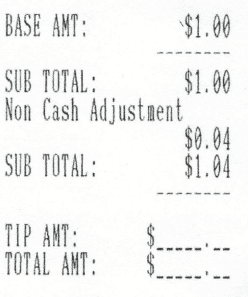

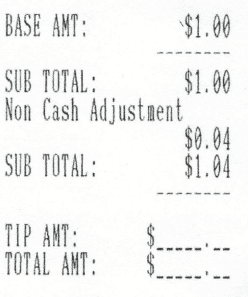

Finally, all points of transaction, including the service fee, must be shown on the customer’s receipt.

Will this lower sales?

A common misconception among merchants considering implementing a cash discount program is that it will lower their sales volume.

Many customers don’t carry cash with them at all times. If they do, they may want to save it for emergencies. So if these customers can’t save money by paying with cash, will the nix the purchase all together?

Paying with a credit card offers a convenience for customers. They will be able to track payments through their monthly statements, and they can make purchases without having to carry cash.

Overall, paying with a credit card remains more convenient than paying with cash, even with an added service fee. Research shows that customers disregard the service fee 98.7% of the time.

Rather than lower sales, you’ll completely eliminate credit card processing fees and increase the overall profit of your sales.

Technologies

You need to be using the right technology in order to eliminate your credit card processing fees.

The right credit card processing companies equipped for cash discount processing will provide you with a terminal to process credit card transactions.

These terminals will add the service fee to a customer transaction. Next, the fees for processing the card will go directly to the processing company who will then use the service fee to pay off all your monthly fees!

Switching to a processing company equipped for a cash discount program is simple and can be accomplished in just one afternoon.

You’ll get the full purchase price for all of your transactions, and you’ll always pay $0 toward credit card processing fees!

Terminal companies make an array of credit card terminals capable of adding service fees and transferring processing fees to the processing company. Business owners can choose from models that work well with multiple business types.

Some of these models include countertop, wireless, and touchscreen terminals. All you have to do is chose the one that best fits your business!

Is this a good fit for my business?

It may sound daunting, and you probably want to know if this can work for your business.

Eliminating all credit card processing fees sounds great, but will it really work for you?

In truth, cash discount programs are a great fit for many different business types.

What if I have a large business?

Large companies, such as chain stores, may process a greater number of credit card transactions in a month due to their size.

As a result, more money will be saved when they eliminate their credit card processing fees.

Here’s an example:

Let’s say a business with 10 locations processes an average of 10,000 transactions every month at each location.

If the average purchase amounts to $10, and the merchant pays a total of 4% in processing fees for each transaction, he pays $0.40 per transaction, $4,000 a month for each location, and a sum of $40,000 every month for all locations.

That’s $480,000 down the drain every year!

This money could all be saved by eliminating processing fees.

What if I have a small business?

Small businesses can also benefit from a cash discount program.

Just like large chain stores, small businesses pay a percentage of their profits toward credit card processing fees while operating under a traditional credit card processing system.

For example, a small store at the local business level may only process 1,000 transactions every month with the average sale equaling $15.

By these numbers, the store should be making $15,000 every month.

However, processing fees require an average of 4% of every transaction. The merchant must pay an average of $0.60 for every sale. That’s $600 every month.

Now, rather than earning $15,000 per month, the business owner only has $14,400.

A cash discount program will eliminate all credit card processing fees, even for a small business.

With a cash discount program:

Let’s take the previously mentioned example of a small local business and add in the adoption of a cash discount program.

If you are a customer entering in a small business like this, you may only notice small differences.

As previously mentioned, this business will be required to notify the customer of the service fee prior to the point of sale. You may see a sign at the door or by the credit card terminal informing you of a discount if you decide to pay with cash.

Once you have chosen the product you will purchase, the sales representative or cashier may ask if you would like to take advantage of the cash discount while informing you of the service fee.

You may decide to pay with cash, but you will most likely opt for the convenience of using a credit card even after learning of the small service fee.

Now, all that’s left to do is go home and enjoy your purchase!

As you can see, the buying and selling process changes little from a business that uses a typical processing system to a business that has adopted a cash discount program.

Neither the merchant nor the customer is inconvenienced, and the business owner will appreciate it when they receive their monthly statement.

What will your company look like with a cash discount program?

Probably pretty similar to what it looked like before.

Cash discount programs won’t require you to change your sales or marketing strategy. Your business will look just how you like it to, and your customers will remain happy.

However, when you receive your monthly statement, you’ll notice a lot more money going into your account!

That’s because all the money that you would have paid toward processing fees now remains in your pocket.

You don’t have to pay a dime! That’s the magic of cash discounts!

Are you still paying for the ability to accept credit cards? Maybe it’s time to make the move to Cash Discount for your business. If you’re ready to learn more, check out a real-life case study that’s turned one business owner’s former fees into profit.