I don’t know about you, but when I hear the stories of the best customer service examples, it makes me a bit emotional. There’s something about seeing a company or employee go far beyond the norm that gets me every time.

I don’t know about you, but when I hear the stories of the best customer service examples, it makes me a bit emotional. There’s something about seeing a company or employee go far beyond the norm that gets me every time.

I have been present to many of the customer service examples that we will walk through below. You will not find the same 10 stories that litter the web in this article. These are the stories that I have been there for. These are the stories I have encountered that made me check the level of customer service in my business.

Table of Contents

ToggleBest Customer Service Examples #1 – Apple Computers

I’ve been a Mac user for about 13 years, and I visit the Genius Bar once or twice a year. It’s fun to visit and have something upgraded or repaired when it’s under warranty.

About 2 years ago, I was at the Genius Bar having my aging MacBook Pro looked over. I couldn’t help but overhear and witness the interaction of the woman next to me having her Mac Pro desktop computer evaluated.

She walked into the store with this large computer in its original box and plunked it down on the desk. The condition of the box and design led me to guess the computer was roughly 5 years old.

The Apple rep asked what seemed to be the problem, and here’s what she said. “I’ve been using this computer for years without any trouble, and yesterday I went to turn it on and I get nothing. I have so many pictures on here that I just have to get off, and I’m worried that I’ve lost them forever. Can you help me?”

The Apple rep said that he would need to take the computer into the back room and check it out. He promised that he would be back in a few minutes and know more.

I proceeded to talk with my rep about the issue I was having with my laptop screen. A few minutes go by, the other rep returned and here’s what I watched unfold.

The apple rep said, “We hooked up your computer in the back and we found the same exact problem you told us about. We opened up the case, and it appears that the liquid cooling lines inside the computer have burst. There is now cooling fluid inside the machine, and that’s going to be an expensive repair.”

“I checked the date that you bought your machine, and you are about 18 months past your warranty date. The computer isn’t covered under warranty any longer.”

I watched as the woman went from terrified to tearful as the rep was giving her the diagnosis.

“What I can do though, is I can give you a brand new Mac Pro computer. The cooling lines appear to have burst with age, and we want to make this right for you. We will also do all that we can to recover your data and put it on to the new machine for you.”

“Would it be ok if we kept your old computer and did some work to see what we can save on your hard drive? If that’s alright, we will load it on to the new computer for you when you come pick it up.”

At this point, I wanted to stand up and clap. I had completely forgotten about the reason I was there in the first place. I have no idea who this woman was, but I can guarantee that on this day they won a customer for life. They also influenced many others in the store who watched the interaction. I know that they can’t do what they did that day for everyone, but for the woman I met that day, they got it right.

Example #2 – Chick-fil-A

I often work remotely for my business, and Chick-fil-A is one of the places that I frequent. With my laptop, large Lemonade and free refills, there isn’t much I can’t do. I don’t frequent any particular individual restaurant for them to know me or see me as a regular. I am often impressed by their level of customer service.

One day, I had just finished up a set of meetings and was ready to settle in for the afternoon. I just needed a Spicy Chicken sandwich and a Lemonade, I was ready to tackle my to do list. I walked into the restaurant, and I was greeted by a friendly cashier.

I was expecting, “Welcome to Chick-fil-A. What can I get started for you.” Instead, here’s what I heard.

“Welcome to Chick-fila. Would you like a free sandwich today?”

I started looking around. Was this a prank? Are there cameras somewhere that are recording this for a commercial? I asked if there was some promotion going on that I was unaware of, and she said, “Nope. Our team just thought it would be a good day to give away some free sandwiches and brighten people’s day.”

I didn’t know how to react when she stopped talking. I felt like I needed to insist on paying for my sandwich, but she wasn’t having any of it. I paid for my lemonade and sat down quite a bit happier than I was when I entered the restaurant.

Their plan had worked, and I have to tell you, I enjoyed watching the next 20 customers go through the same thing. The angry scowls from the weight of life melted away as a free sandwich unexpectedly fell in their lap.

When I’m driving around town deciding where I’m going to set up shop for the day, I choose Chick-fil-A much more often than I used to. I don’t go there hoping to score another free sandwich, I go there because they continually go out of their way to treat me well.

(That, and their lemonade is just plain amazing…)

Example #3 – American Metro Cash Registers

American Metro is a family owned point-of-sale and cash register company headquartered in Minnesota. I had an opportunity to watch the American Metro team during an event where they provided on-site support.

There was a team of 5 staff members who were watching over 100 cash registers at the Vera Bradley outlet sale. This event held once a year sells off any excess inventory the company has on-hand. I was there to take pictures of the event, and I had the opportunity to see the American Metro team in action.

I watched as thousands of customers dragged huge bags of merchandise to the check out area. The room was full of hundreds of temporary cashiers helping out for the event. The American Metro team ran about fixing registers and answering questions about sales software.

What stood out to me was what happened when things got busy and the lines were starting to stretch long. There were a few cash registers that didn’t have operators. I watched one of the guys from American Metro walk over and casually open a new checkout lane.

There weren’t any calls for service around the room, he was standing there ready to help if there was a problem. He was getting paid for standing there, he didn’t have to help. He went above and beyond his contract to reduce bottlenecks at the event for no extra pay.

Another 60 seconds, and I watched another American Metro employee start up another register. A few minutes later, another register opened with another team member. Customers were all smiles watching these guys jump in to help.

The Metro team showed incredible customer service that day to their client Vera Bradley. The team members had latitude to go beyond their contract and provide excellent customer service. I watched the team help out for hours beyond what was in their contract or expected of them. Their actions made an impression on me, and I hope the good folks at Vera Bradley took notice. The American Metro team was an amazing customer service example that day.

Example #4 – WestJet Airlines

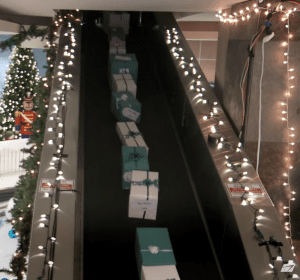

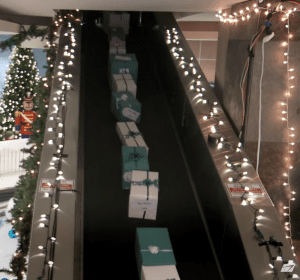

Great customer service examples usually have a hint of the unexpected. When it comes to stories that have a twist, there aren’t many better than the WestJet Christmas.

It’s a few weeks before Christmas, and just like any other day, a flight is preparing to take off for WestJet. This flight would be a different experience for the passengers preparing to board.

When customers arrived in the terminal, they saw something different. WestJet had set up a giant Christmas present in the terminal with a note that said, “Scan your boarding pass here.” Once scanned, the screen lit up with a video of Santa, and it was interactive!

While the flight was on its way to the destination, WestJet had a surprise in store. Dozens of WestJet employees raced all over the arrival city to buy items from Christmas lists.

WestJet staff members rushed into electronics stores. They rushed into clothing stores and outdoor specialty stores. All over town, WestJet was scouring the landscape for gifts to surprise their passengers.

Rather than luggage coming down the conveyor, a stream of Christmas packages appeared. Each package had a tag addressed to every passenger on the flight.

Winter scarves appeared, underwear and socks as well. Teens were knee deep in gaming systems and headphones. Children played with new toys and parents watched with mouths wide open.

Example #5 – Benjamin Franklin Plumbing

I was at home with the family on a lazy Saturday afternoon when my wife called from the kitchen. She asked me why the kitchen faucet was only dripping instead of the usual water pressure.

Being a manly man, I did the masculine thing. I called Benjamin Franklin Plumbing to check it out.

A few hours later on a Saturday, my technician arrived. He put on his little foot booties and we took a trip into the kitchen.

We turned on the faucet to see the same lack of water pressure my wife described. We checked toilets, sinks, and other water fixtures around the house and came to a conclusion. Our water softener had bit the dust.

Upon closer inspection there were little resin beads everywhere. Resin beads were clogging up every faucet and shower head in the house. It was a mess.

My technician’s plan of attack wasn’t what I expected, and here’s where the story gets fun. I asked him what the cost would be to make everything right again, and here’s what he said.

“With your water softener going out, it’s going to need replaced. That’s something I can do for you or if you’re up to it you can do it yourself.”

Do it myself? Since when do service technicians leave you the option of not getting the business? I thought it was strange that he even brought it up, but we continued.

“First, we need to bypass your water softener. What needs to happen is every faucet and shower head in your home needs removed and washed out. Those beads will be everywhere for about the next 2 weeks and they’ll need cleaned out many times.”

“If you feel like you’re up to the task, you can do all this yourself and I can just be on my way.”

I told him that I would like to try to attack this myself and I asked him how much it would cost me for the service call. He did come out on a Saturday after all, and I was expecting a premium bill.

My technician said, “You’ve got enough expense to deal with here by having to replace your whole unit. Would it be okay if we just called this a friendly visit and I waived any trip charge today?”

On that day, Benjamin Franklin plumbing made a customer for life. I have no doubt that some day soon my drain will back up or my water heater will start leaking. When that day comes, I have my little magnet that shows me who to call.

I know my new best friend works there, and I’d love to see him again.

Example #6 – Lego

This fantastic customer service example comes from how the Lego company reacted to a 7 year old boy. Luka had just saved enough money to go out and buy a Jay ZX Lego set. In the middle of playtime the family needed to make a run to the store.

Luka’s dad warned him not to take his Minifigure to the store with him. He was afraid he would lose it in all the hustle and bustle of the shopping trip. Luka decided he knew best and took Jay ZX with him to the store.

Luka’s dad told him that there wasn’t more money to go back and buy another set. Buying another entire set just to get the small Minifigure was too expensive. Left without options, Luka emailed Lego and owned what he did in his email.

Here’s a copy of Luka’s email to Lego.

“Hello.

My name is Luka Apps and I am seven years old.

With all my money I got for Christmas I bought the Ninjago kit of the Ultrasonic Raider. The number is 9449. It is really good.

My Daddy just took me to Sainsburys and told me to leave the people at home but I took them and I lost Jay ZX at the shop as it fell out of my coat.

I am really upset I have lost him. Daddy said to send you a email to see if you will send me another one.

I promise I won’t take him to the shop again if you can.

– Luka”

(Picture of the Ultrasonic Raider shown below.)

Here’s the reply from the Lego customer service representative.

“We are very sorry to hear about you losing your Jay minifigure but it sounds like your dad might have been right about leaving it at home. It sounds like you a very sad about it too.

Normally we would ask that you pay for a new one if you lose one of your minifigures and need to have it replaced.

My bosses told me I could not send you one out for free because you lost it but, I decided that I would put a call into Sensei Wu to see if he could help me.

Luka, I told Sensei Wu that losing your Jay minifigure was purely an accident and that you would never ever ever let it happen ever again.

He told me to tell you, “Luka, your father seems like a very wise man. You must always protect your Ninjago minifigures like the dragons protect the Weapons of Spinjitzu!”

Sensei Wu also told me it was okay if I sent you a new Jay and told me it would be okay if I included something extra for you because anyone that saves their Christmas money to buy the Ultrasonic Raider must be a really big Ninjago fan.

So, I hope you enjoy your Jay minifigure with all his weapons. You will actually have the only Jay minifigure that combines 3 different Jays into one! I am also going to send you a bad guy for him to fight!

Just remember, what Sensei Wu said: keep your minifigures protected like the Weapons of Spinjitzu! And of course, always listen to your dad.

You will see an envelope from LEGO within the next two weeks with your new minifigures. Please take good care of them, Luka.

Remember that you promised to always leave them at home.”

If you’ve been in business for any length of time, you’ve met the haters. They’re out there just to rant against something you’ve done or not done in your business. Some customers have legitimate complaints and others just have preferences.

Some just complain about what your company offers. In this instance of a best customer service example, the representative went far above and beyond. He entered the play world of the customer and delivered an amazing customer service example.

Example #7 – Chick-fila (again?)

The company has been in the news quite a bit in the last few years for their stance on various cultural issues. Issues like marriage equality and religious beliefs seem to make the news quite often.

There are some who believe that the company isn’t warm towards the LGBT community. As our most recent national tragedy unfolded down in Orlando, a local Chick-fil-A responded. What occured was a customer service story that flew largely under the radar.

A shooting at a nightclub in Orlando happened to occur in a gay nightclub. Many lives were lost and many more wounded in the standoff. The local community rallied in the days following to donate blood and support survivors.

Many survivors and supporters were a part of the LGBT community. Some would say that Chick-fil-A might sit this one out, but what happened was the opposite. One local Chick-fil-A decided to open their doors on Sunday. (a day in which all Chick-fila stores are famously closed)

The team cooked up chicken sandwiches and sweet tea to take to those who were donating blood for the victims. The local manager had the leeway to make this decision. The company trusted him to make a decision to support where he saw a need.

A national tragedy in Orlando gives us a window into a company that has customer service at its core. Chick-fil-A is a company that encourages their people to go the extra mile. They want to enable their people to make a difference in their local communities, and it shows.

Example #8 – Heartland Church

In my daily business life, I’m often out and about and working from a coffee shop or restaurant. Saving small businesses money on their credit card processing is what we do here at Dual Payments, and I can blog about that anywhere. Sometimes I’m grabbing lunch on the go between writing sessions as I rush around helping our customers.

As I was out and about in my daily routine, I pulled into the drive thru at my local Taco Bell. I made my usual order of a cheesy gordita crunch and a bean burrito. (don’t judge me, they’re delicious!) When I got to the window and handed them my card to pay, here’s what happened.

I had received a free meal from a random stranger who wanted to show me that someone cared. I loved it to be honest, and the story didn’t end there.

I was out doing my thing about a week later, and for lunch on this particular day Wendy’s called my name. I pulled into the drive-thru and ordered the spicy chicken sandwich. (no haters here, you all know how good that sandwich is.)

I pulled up, and again I received a little blue card that said, “Here’s something a little extra. Have a great day.” I was told that the person in front of me paid for my meal and that they just wanted me to get this little card.

Often it’s thought that non-profit organizations and churches in particular just want our money. Here was a church that just wanted to show me something different than what I expected.

Conclusion

Whether you’re a service organization or a business that sells widgets, customer service still wows customers.

Is your business intentionally providing excellent customer service like the examples above?

What is one step you could take today to offer an amazing customer service experience?

Write a comment in the section below, and I can’t wait to tell your company story in round 2 of the best customer service examples.